The first step is to create a Debtor Account in MYOB so that all Debtors sales in Idealpos can use this one Debtor Account. It is not necessary, nor is it possible to link individual debtor accounts in MYOB for every POS debtor in Idealpos, as Idealpos is able to perform all normal Debtor functions such as Customer Invoicing, Payments, producing Customer Statements, Customer Sales Reports, Trial Balance reports and more.

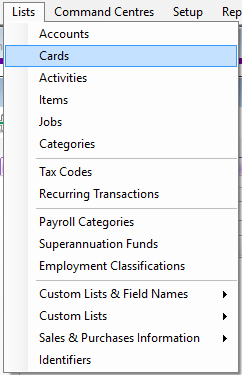

In MYOB, go to Lists > Cards, select ‘New’ and create a new debtor (“POS Debtor”)

Make note of the Customer Account Name in MYOB as this will need to be entered into the Debtor Code in Idealpos.

To enable this option in Idealpos, go to Setup > Global Options > Accounting, and down the bottom of the screen, enter the exact customer name created in MYOB (eg “POS Debtor”) into the Debtor Code field.

The Profit & Loss (Accrual) Report will display both paid and unpaid debtor sales:

In MYOB, go to Reports > Index to Reports

Under Accounts > Profit & Loss, select ‘Profit and Loss Statement’, enter the date range and select ‘Display Report’.

The Profit & Loss (Cash) Report will only show invoices that have been paid:

In MYOB, go to Reports > Index to Reports

Under Accounts > Small Business Entity, select ‘Profit & Loss (Cash)’, enter the date range and select ‘Display Report’.

The GST (Cash) Report will show the Tax Collected once the invoice is paid.

Under GST/Sales Tax > GST Reports, select ‘GST (Cash)’, enter the date range and select ‘Display Report’.